Ali Baba and the Chinese princelings

Alibaba, the Chinese online business, last week raised $25bn in what is now the world’s largest ever stock market flotation. This values the company at more than Amazon and Facebook.

But what are people actually buying? The answer is not much, other than rights to a highly risky offshore structure that doesn’t own Alibaba.

Alibaba operates in China. But the shares listed on the New York Stock Exchange are in a holding company registered in the Cayman Islands. This in turn is related to a number of Chinese companies through a complex structure of intermediate holding companies in the BVI, Cayman and Hong Kong. The whole corporate structure has been helpfully reproduced by the FT here.

Why such a complex structure? The answer is surprisingly simple. Under Chinese law, there are restrictions on foreigners owning technology companies. To get around this, several Chinese firms have set up “variable interest entities”. In this kind of offshore structure the ownership and control of the company stays in China which then moves profits offshore through a series of contracts which pays royalties, fees and other charges to the offshore holding company. Investors are only buying a right to this income rather than any ownership in the company actually making the profit.

The big problem with this is that the contracts upon which the whole system relies are only enforceable in China, and the Chinese government has never clarified where it stands on these offshore structures. This makes the whole pyramid extremely precarious. The Congressional US China Economic and Security Review Commission described the situation as “highly risky” in a report on variable interest entities.

Furthermore Alibaba has been on a spending spree, buying up a whole bunch of companies which could put it in breach of Chinese anti-trust law. How does Alibaba manage to get away with all of this?

The report from Congress has a few ideas. It says that several sons of high ranking Chinese officials hold stakes in Alibaba (which it suggests is one reason why the company has had an easy ride from regulators until now) as does Russian oligarch, Putin ally and second largest Arsenal shareholder, Alisher Usmanov.

While big shots in New York and London have piled into Alibaba shares following the IPO, the Wrapper Towers’ Fund (WTF) will be putting our reader’s billions elsewhere.

The school (gold) run

The school (gold) run

Money laundering, illegal mining, tax fraud. Not things you usually do on the school run. Unless you are going to Hugenote High School in South Africa.

An investigation by Carte Blanche, the South African investigative journalism series has lift the lid on South Africa’s illegal gold trade. It is an incredible story of freelance goldminers, middlemen, smugglers, fraudsters and tax cheats.

Abandoned mines are raided for any leftover gold. This is then processed in cottage industries before making its way onto the black market. The main incentive is collecting a tax break on recycled jewellery, so documents are forged to show that gold comes from melted down rings.

As part of their investigation Carte Blanche came across a surprising middleman, High School principal Frans Styger, who was prepared to use his school to facilitate gold trades, for a fee of course. Since the report was broadcast Frans has been placed under investigation by the Department of Education.

Susan Comrie – a participant of TJN’s Illicit Finance Journalism Programme – was the senior journalist working on the investigation. You can watch the full 20 minute programme here.

Lonmin is in a deep hole

Staying in South Africa, leading South African politician Cyril Ramaphosa and vice president of the ANC looks to be in some difficulty over the actions of Shanduka Group, an investment company he had a substantial stake in.

It can now been revealed that for years Lonmin, the mining company was paying royalties to a company in Bermuda who was apparently marketing their metals for them.

Perhaps this was due to the convenience of being located close to major metal exchanges such as London. Or maybe, it was a tax dodge.

Even more surprisingly, Lonmin executives said in testimony to the Marikana Commission (set up to look at the massacre at the Lonmin mine where 44 people died) that for years the company tried to close the Bermuda operation down. But the closure was blocked by the black empowerment consortium on the board. This since 2010 has been owned by Shanduka group. The board member from Shanduka on the Lonmin board? Cyril Ramaphosa.

Questions are being asked of Ramaphosa, who until now has had some harsh words for corporate tax avoiders, saying that they were committing a crime against every South African.

The piece was written by Craig McKune of the M&G Centre for Investigative Journalism – another IFJP alumni!

Build yourself an Ikea tax dodge

It is well known that Swedish flat-pack, furniture giant IKEA avoids huge amounts of tax though its charitable status which sees it pay a tax rate of just 3.5% – despite the fact that it seems to donate very little to charity.

However, if you ever wanted to learn about this rather incongruous state of affairs in a visual format you now can. The website, One Minute MBA has come up with this great visualisation explaining how Ikea does it.

Watch the video

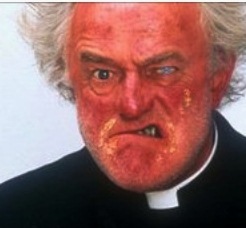

Don’t tell Father Jack

Pascal Saint-Amans, head of tax at the OECD, was in the tax haven of Ireland last week. The energetic, stubble-faced, profit-shifting-buster was keen not to blame his hosts for its part in allowing hundreds of billions of dollars to leak out of other countries though structures such as the double Irish.

In fact, according to Pascal, Ireland is the victim:

“Ireland has been misused by a number of companies to locate the profit in Bermuda to use check the box which is in American companies. Is Ireland guilty? Of course not. It’s being used.”

Ireland, akin to a fallen woman? What on earth will Father Jack say?

Leave a Reply