“Tax is the Lifeblood of Democracy”: An Interview with John Christensen of the Tax Justice Network Spirit of Contradiction

Australia: Miners in a royal spin over tax contribution The Sydney Morning Herald

Pakistan: Our Swiss dilemma The News on Sunday

Monaco $400 Million Penthouse Secrecy Booms: Real Estate Bloomberg

On “tax tourism”: “Developers prepare for an influx of millionaires and billionaires escaping higher taxes or a loss of banking privacy”, as Switzerland’s financial-secrecy appears to be crumbling.

UK Prime Minister Cameron family fortune made in tax havens The Guardian

UK government looks to make offshore tax evasion a criminal offence City Wire

Bangladesh: Drive launched to check tax evasion through transfer pricing The Daily Observer

U.S.: 20 Tax Dodgers: $240 Million for CEOs, Big Loss for the American People Center for Effective Government

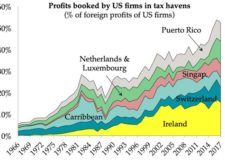

Corporate foreign tax moves have bedeviled U.S. for decades Reuters

Credit Suisse played role in Espirito Santo collapse-WSJ.com Reuters

The Swiss bank helped put together billions of dollars in securities that were issued by offshore investment vehicles.

Citibank could lose Argentina banking license New York Post

A bank losing its license is a very serious step. We have asked the question as to why this did not happen in the tax evasion cases of Credit Suisse and UBS, allowed to continue business in the USA.

When companies flee U.S. tax system, investors often don’t reap big returns Reuters

See also: NY Times: Behind Closed Doors, Obama Crafts Executive Action on Tax Inversions TaxProf

Another French footballer under tax evasion radar swissinfo

America revealed as top spot for China’s “naked officials” ICIJ

Leave a Reply