Very important insights. See also Credit Suisse escapes worst as it pleads guilty to U.S. charges Reuters – New York regulator decides not to revoke the bank’s license, and top management stay in place, and Credit Suisse Clients Remain Secret as Bank to Help U.S. Bloomberg “It is a mystery to me why the U.S. government didn’t require as part of the agreement that the bank cough up some of the names of the U.S. clients with secret Swiss bank accounts,” said U.S. Senator Carl Levin.”

Glencore must end secrecy around its finances, says Christian Aid

See also: Glencore pumped president’s friend with cash as it took over prize Congo mine Global Witness, and this gem.

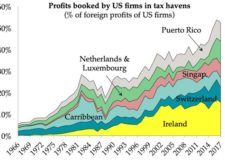

Dozens of Companies Admit Using Tax Havens Citizens for Tax Justice

New report finds 301 Fortune 500 companies hold a combined $2 trillion offshore, collectively avoiding $550 billion in U.S. corporate income tax.

I applied the public interest test to the big pharma deal and Pfizer failed The Conversation

Prem Sikka comments.

GSK dodged millions in China drug tax scam – state media Reuters

Slow start to UK hunt for ‘hidden millions’ Guernsey Press

Lawyers: War on tax avoidance may scare investors The Scotsman

Taking the ostrich position. Hat tip: Offshore Watch

The Money-Laundering Vatican Bank Comes Clean The Daily Beast

Leave a Reply