The Offshore Wrapper is written by George Turner

“In Formula One, everyone cheats. The trick is not to get caught.”

That is what Bernie Ecclestone reportedly once said according to his biographer Tom Bower about the motor racing circus he runs.

There is absolutely no suggestion, however, that Bernie was talking about his tax affairs when he made this alleged remark.

But an investigation by BBC programme Panorama claims that the Formula One boss may have avoided a staggering £1.2bn to £2bn in taxes, in what is being described as the UK’s largest ever tax dodge.

The scheme reputedly involved gifting all of his assets to his ex-wife Slavica who then placed them in a family trust in Liechtenstein (a well known Formula One destination).

The UK’s tax authorities spent nine years investigating the deal, but offered to settle in 2008 for just £10m.

Eccelstone is currently facing bribery charges in Germany which he strenuously denies.

The BBC reports that Ecclestone has said he has always paid his fair share of tax and that he is “proud to be British and proud to make my contribution by paying my taxes here.”

With a deal like that – he should be whistling “God save the Queen,” all day long.

Google gets a $1bn tax bill from the French

Corporate filings from Google have revealed the French have said “non” to the company’s Double Dutch Irish tax structure and handed the company a $1bn bill in back payments.

In their accounts Google say they are reasonably confident of winning the dispute, but that it may change their tax position.

Watch this space!

International criminals and terrorists love UK companies

The UK Prime Minister David Cameron has sent a letter to the UK Overseas Territories calling on them to set up registers of beneficial owners along the model being adopted by the UK.

The response will be interesting. The UK’s Overseas Territories include some of the most notorious secrecy jurisdictions in the world. Forcing disclosure of beneficial ownership could seriously dent their appeal to the world’s money launderers, tax dodgers and organised crime bosses.

But simply having a register is not everything, and David Cameron would do well to look at the mess that has been built up in his own stable.

A recent research report by World-Check has shown that almost 4,000 people who are appear on various international watch lists are registered as directors of UK companies.

This included 154 people allegedly involved in financial crime, 13 individuals wanted by Interpol for alleged terrorist activities and 37 accused of involvement in the drugs trade.

1,000 politically exposed people (politicians or high ranking government officials) are also listed as company directors.

Mauritius in the firing line

Some 16 civil society organizations have united to petition African governments to review tax treaties with tax havens according to Kenya’s Standard.

The group, which includes the Tax Justice Network Africa as well as Christian Aid, Action Aid and the Kenya Debt Relief Network say that double taxation agreements have become a tool for “double non- taxation.”

Mauritius comes in for particular criticism, being referred to as Africa’s own tax haven.

India has already taken note and action it would seem. Foreign direct investment from Mauritius to India halved in the second quarter of last year. Investors say that they are pulling out of Mauritius due to fears that the tax advantage of investing in India may be eliminated by the new Indian anti-avoidance rule and the renegotiation of the double taxation agreement.

Despite this, according to the Mauritian Finance Minister Xavier-Luc Duva, Mauritius is most definitely not a tax haven.

India gets tough with Cyprus?

Mauritius isn’t the only place India is unhappy with. Mint reports this week that India is close to signing a new double taxation agreement (DTA) with Cyprus. This will toughen up the current DTA.

India placed Cyprus on a blacklist after the country refused to disclose information on investments in India. Cyprus was the first country to receive this treatment under tax rules made in 1961. It meant that Indian tax residents with entities in Cyprus were subject to enhanced reporting requirements and other measures.

Indian officials say that the dispute is close to ending with a new agreement that will allow for information exchange along the OECD model.

However, India may need to go further. Research from other tax havens which have adopted OECD style on-demand information exchange shows it to be a fairly useless tool.

Dash by politicians to stash cash offsore before election? Surely not…

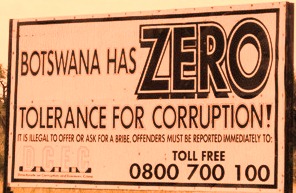

A recent article by Botswana’s Sunday Standard highlight’s the work of the Tax Justice Network in quantifying the huge amounts of the country’s wealth held offshore.

One of the more curious trends discovered is that the level of outflows seems to increase in election year.

Could this be down to worried politicians stashing cash in offshore banks before the electorate boots them out?

You may think that. But The Wrapper could not possibly comment.

Leave a Reply